ステーキングとは? 仮想通貨(暗号資産)による新たな資産形成、収益方法の形

ステーキングは仮想通貨(暗号資産)を保有しながらインカムゲインを得る方法です。仮想通貨のレンディングサービスとは仕組みも運用方法も異なり、ブロックチェーンを利用した新しい形の資産形成であり、収益方法です。今回はステーキングについて解説しますので、皆様のステーキングライフのお役に立てれば幸いです。

ステーキングとは?

ステーキングとは、仮想通貨を保有しているだけで、年率換算3%~6%の報酬が得られる仕組みです。報酬の支払い間隔も短く毎月や毎週のペースで報酬が得られます。以下で紹介するカルダノADAのステーキングは5日おきに報酬が得られます。

仮想通貨のレンディングサービス(口座に預けている仮想通貨を第三者に貸し出し、利息で利益を得る手法)とは異なり、全ての仮想通貨がステーキングに利用できるわけではありません。コンセンサスアルゴリズムというブロックチェーン上の取引内容を記録する際の合意形成方法(ルール)にPoS(Proof of Stake)を使用している仮想通貨のみがステーキングの対象となります。

レンディングサービスの違いとしては以下の点があげられます。

- PoSのコンセンサスアルゴリズムを使った仮想通貨のみが対象

- レンディングサービスでは一定期間仮想通貨の使用をロックする必要があるが、ステーキングでは決められた期間の縛りがない

- 別途契約の必要がない

レンディングサービスよりもステーキングサービスの方が自由度が高く、かつ簡単に開始できる特徴があります。

ステーキングの仕組み

ステーキングの仕組みを理解するためには、コンセンサスアルゴリズムの一種であるPoSを理解する必要があります。コンセンサスアルゴリズムは、ブロックチェーン上の取引内容を記録をする際の合意形成の方法(ルール)の事です。

ビットコインは、PoW(Proof of Work)と呼ばれるコンセンサスアルゴリズムを使っています。PoWは複雑な計算を先に処理したマイナーがブロック生成の優先権を得る方式です。その為、より早く計算ができるようにハイスペックのサーバーが揃える必要があり、ハードウェアの電力消費も大きく、スケーリングが困難で、環境にも優しくないという批判もあります。

最近では、PoWのデメリットを補う新しいコンセンサスアルゴリズムとしてPoS(Proof of Stake)が主流になってきています。PoSではブロック生成の基準の一つとしてトークンの保有量を考慮するというもので、保有(Stake)量が多い者を優先します。

その報酬として、トークンが支払われ、それがステーキングの収益の源泉となります。PoSを利用した仮想通貨として最近最も注目を集めているのが、カルダノ(ADA)です。

PoSとは?

プローフ・オブ・ステーク(Proof of stake)は仮想通貨のブロックチェーンネットワークにおけるコンセンサスアルゴリズムの一種で、保有している仮想通貨の量が多いほど取引の承認権(新しいブロックをブロックチェーンに繋ぐ権利)を得やすい仕組みです。ステーキングをする事により報酬が得られるので注目が集まっています。「保有量」を確保するユーザーが増える事でブロックチェーンの分散化も加速します。エコシステムとしても評価されており、PoWに代わる次世代のアルゴリズムとして認知され始めています。

簡単に比較すると以下のようなイメージです。

| ビットコイン(BTC) | カルダノ(ADA) |

| マイニング | ステーキング |

| 消費電力が多い | 消費電力が少ない |

| 送金速度が遅い | 送金速度が速い |

| 送金手数料が高い | 送金手数料が安い |

ステーキングのメリット

ステーキングのメリットとしては以下の点が挙げられます。

- 最低保有数量の規定はあるが、保有数量の上限がない

- レンディングサービスのように貸し出しのニーズがなく貸し出すことができないということがない

- 保有している仮想通貨はロックされない為、いつでも売却したり送金することが可能

- 定められた期間の縛りがない

- 資金・資産の分散管理になる

- 毎週報酬が支払われるなど、報酬を得られるサイクルが短い

ステーキングのデメリット

ステーキングのデメリットとしては以下の点が挙げられます。

- 対象銘柄が少ない

- 報酬が一定ではない

- 仮想通貨の価格自体の下落

カルダノ(ADA)ステーキング

ADAコインを保有し、カルダノステーキングに参加することで、インセンティブを得ることが出来ます。

ステーキングの保有量に応じて報酬のADAを獲得できます。ステーキングの登録をするだけで、その後はほったらかしで暗号資産を増やしていくことができます。

更に、このステーキングそのものがカルダノの分散化に貢献することになり、カルダノの更なる発展にも繋がります。

そして、カルダノ(ADA)の価格・価値が今以上に向上すると、報酬で貯めたADAの価値は何倍にも膨らむ可能性を秘めています!

カルダノ(ADA)は多くの仮想通貨(暗号資産)の中でも最も将来有望な資産の一つです。詳細はこちらの「仮想通貨(暗号資産)のまとめ・徹底比較、通貨の特徴と今後の将来性」をご参照ください。

カルダノ(ADA)のステーキングの特徴は以下の通りです。

- 保有のADAは専用のウォレット(ダイダロス、ヨロイ)からステーキングすることができます。

- 1エポック(5日間)ごとにステーキング報酬としてADAがもらえます。

- エポックとは、カルダノ時間の単位で、日や週に相当します。1エポックは5日間です。

- 10ADAからステーキングが可能です。

- 保有しているADAはご自身の管理下(手元)にあるので資産のロックはありません。

- ステーキングはただ単にブロックチェーンに対してステーキングするプールを登録するだけです。

- ステーキング中も自由に入出金することが可能です。

ステーキングの始め方・方法

ステーキングはADAを専用のウォレット「ダイダロスWallet」または「ヨロイWallet」に入れて、ステークプールに委任するだけで始めることが出来ます。ヨロイWalletはスマホアプリもあるので、スマホからも簡単にステーキングが出来ます。

数クリックで手続完了し、後は委任先のプールがブロックを生成させるたびに1エポック毎(5日間)に報酬が得られます。詳細なステーキング方法は以下リンク先で画面キャプチャと共に詳しく解説していますので、1〜3いずれかご自身に合った方法をお試しください。

ADAをまだ持っていないという方はこちらの「カルダノ(ADA)購入方法」で同様に詳しく解説していますので、ADAを購入してからステーキングをお楽しみください。

ステーキング報酬の計算

ステーキングによって得られる年間の報酬についてどれくらいか目安を計算できるサイトとその方法をご紹介します。(こちらの計算機はあくまで目安です)

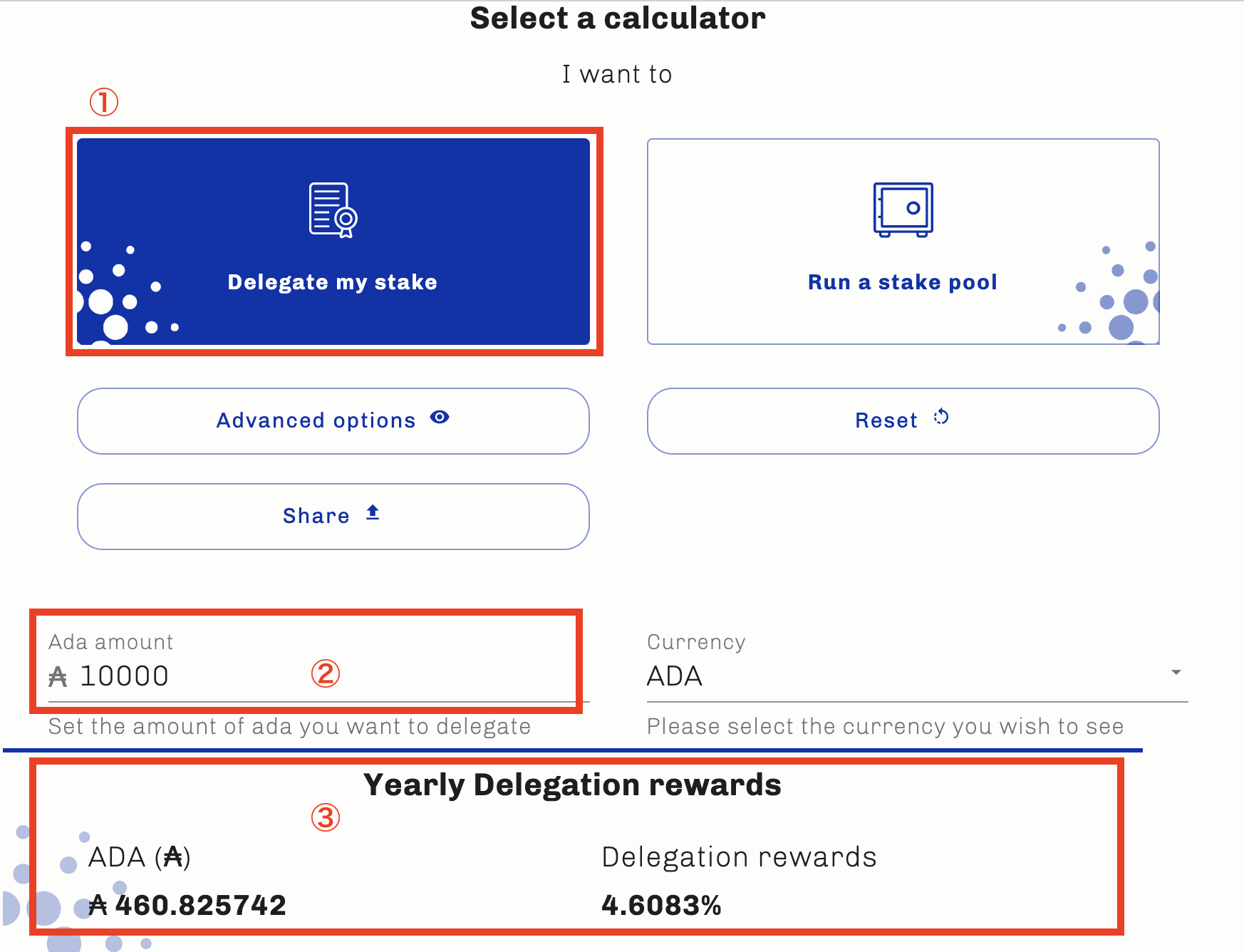

- ①ページ中段の「DELEGATE MY STAKE」を選択し報酬の計算を開始します

- ②「ADA amount」に計算したいADAの量を入力

- ③入力すると自動で計算され「Yearly(年間に獲得できる報酬)」と「Delegation rewards(%)」が表示されます

今回は10,000ADAを委任した場合の報酬を計算してみました。結果は、年間報酬が460.825742ADAで、報酬率4.6083%という結果となりました。

仮想通貨(暗号資産)をただ保有するだけでは、その仮想通貨自体の価値・価格変動による利益しか得られませんが、ADAではただ保有するだけでなく、ステーキングすることでADA自体も増やすことができます。しかも最初に委任登録をするだけで、あとはほったらかしです。皆様のステーキングライフのお役に少しでも立つことが出来ると幸いです。

ADAボーナスプログラム

このように仮想通貨(暗号資産)のステーキングが新しい資産形成・収益方法としていかに有益なものであるかを解説させて頂きました。従来の資産運用の継続ももちろんですが、集中管理することのリスク、少しでも収益が得られる可能性のある資産への投資、将来を見据えた継続的な収益モデルの確立など、様々な観点から分散投資するのは非常に有効な資産管理方法だと言えます。

そのステーキングの中でも、将来性の高いカルダノ(ADA)は目が離せません。時価総額ランキングでも上位に上がってきています。カルダノ(ADA)はADENプールでステーキングが出来ます。またADENプールではブロック生成の節目で委任者の皆様と共に喜び、ボーナス報酬を分かちあうプログラムを開始しました!

通常のステーキング報酬とは別にボーナス報酬が定期的に貰えるプログラムです。詳細は「ADAボーナスプログラム」をご参照ください。

News(2021/7/4)

カルダノのステーキング数量

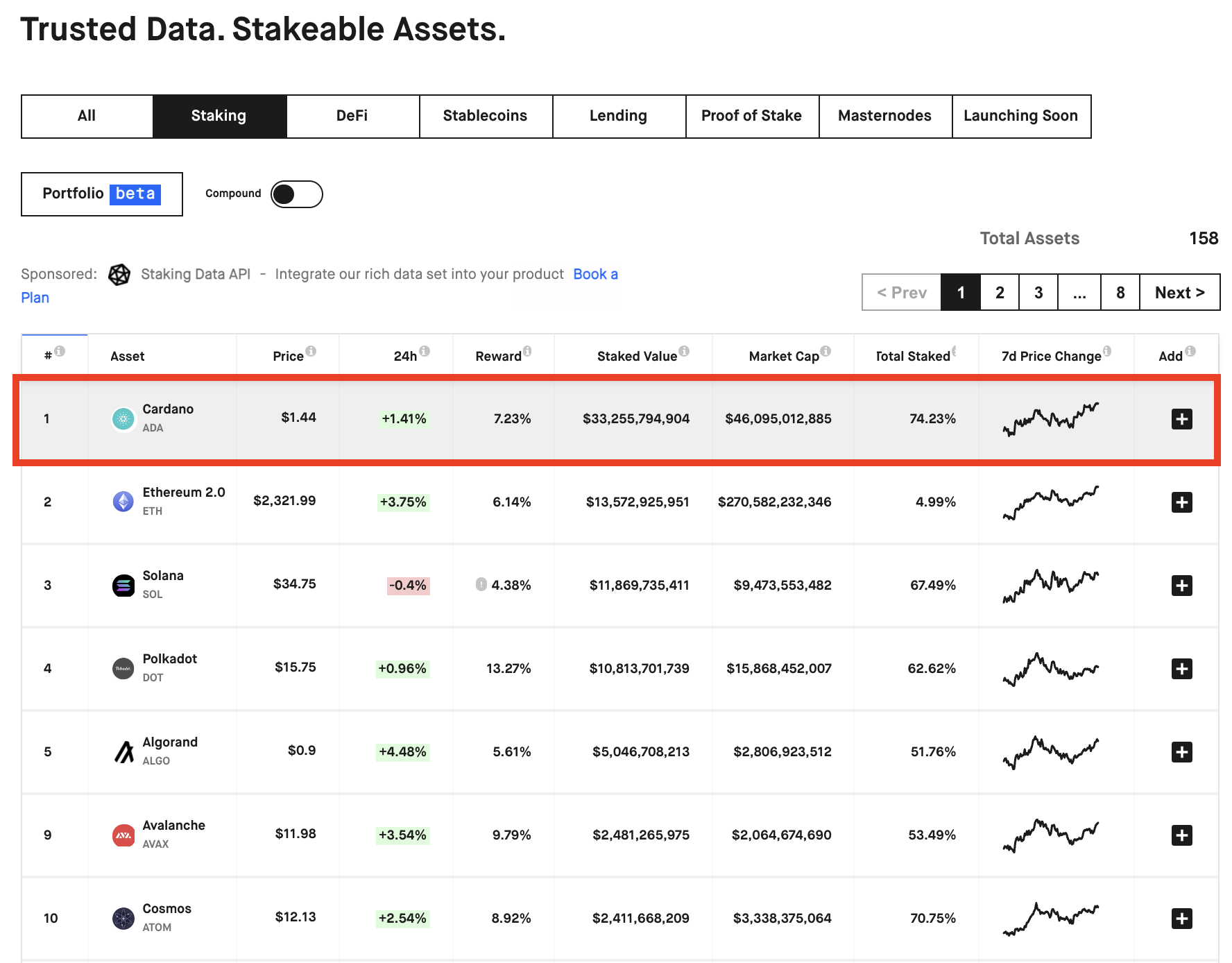

ステーキングに関する情報を提供する「Staking Rewards」では、ステークされている数量をドル換算した金額で確認することが出来ます。本記事執筆時点(2021年7月4日)では1位がカルダノ(ADA)で2位のイーサリアム2.0(ETH)を大きく引き離しています。

カルダノ(ADA)のネットワークでステーキングされている数量は、330億ドル超(約3.6兆円)相当で、現在のステーキング数量は現供給量の74%超にまで増加しています。これだけを見てもいかにカルダノ(ADA)の関心度が高くなっているかが分かります。